Projects on your 2015 SPLOST

- 2015 SPLOST Projects Presentation

- A Review of the 2015 Spalding County SPLOST Projects

- Spotlight on Paying Off Debt

- Spotlight on Fire Department Priorities

- Spotlight on “What is Pickleball and Why is it on the SPLOST?”

- Spotlight on “Swim, Splash, Slide Aquatic Facility”

- Spotlight on “What is Substandard Housing Abatement and Why Is It On the SPLOST?”

- Spotlight on Library Materials and Technology Funding

- Spotlight on GRIP – Gang Reduction and Intervention Program

This information is provided by the governments of Spalding County, City of Griffin, Orchard Hill and Sunny Side it is for information purposes only and does not in any way make inferences as to how a person should vote in the SPLOST referendum.

In order to understand SPLOST is it important to understand the other tax forms in this category:

Local Option Sales Tax are the taxes levied on the sale of goods and services within Spalding County.

There are currently three (3) types of local option sales tax and each one is different in the way it is approved and what it can be used for.

The ultimate goal in a sales tax is to relieve some of the burden on property taxpayers and by virtue of it being a consumption based tax everyone contributes to the tax whether they are a Spalding County citizen or not.Spalding County has a history in the use of two of these taxes: The Local Option Sales Tax (LOST) and the Special Purpose Local Option Sales Tax (SPLOST). The third is set aside strictly for the Board of Education, the Educational Special Purpose Local Option Sales Tax (E-SPLOST) and is used for purposes defined by the Griffin-Spalding Board of Education.

Local Option Sales Tax (LOST) is a major form of revenue for many counties, including Spalding County. This tax is a joint county and municipal local option sales tax. Subject to voter approval, the sales and use tax of 1% may be imposed on the purchase, sale, rental, storage, use or consumption of tangible personal property and related services.

Proceeds from this tax are collected by the Georgia Department of Revenue and disbursed by that agency based on the percentages negotiated by the county government and the cities within each county. One percent of the amount collected is paid into the general fund of the State Treasury to defray the cost of administering this program and a percentage is paid to the entity that collects and reports the taxes.

The remainder is used as revenue for the general fund and reduces the amount of property tax revenue required to fund the annual budget. It requires that the tax bill of each property taxpayer must show the reduced county and city millage rate resulting from the receipt of sales tax revenue from the previous year as well as the reduced dollar amount. All counties and municipalities that impose a joint sales and use tax are required to renegotiate the distribution certificate for the proceeds following each decennial census. The criteria to be used in the distribution of such proceeds and for the resolution of conflicts between the county and its municipalities are set by state law and if the county and cities fail to renegotiate such certificates as required by this law, the tax then terminates.

In Summary:

- LOST is approved by the voters and will continue annually, subject to certain provisions.

- LOST is a joint tax between the county government and its municipalities: LOST collections in Spalding County are distributed between Spalding County and the City of Griffin.

- The law requires that the county governing officials enter into negotiations with the governing officials of the municipalities upon implementation of a LOST and must renegotiate the percentages each will receive every ten years following a new census.

- If a consensus is not reached by all parties in accordance with Georgia Law, then the tax terminates.

- LOST funds distributed go into the general funds of the county and the City of Griffin and reduce the amount of property tax needed to fund the budgets of these governments.

- Tax bills disbursed annually must show the effect LOST has on the millage rate and the estimated dollar amount that the property taxpayer saved because of LOST.

- LOST continues so long as all conditions above are met.

Special Purpose Local Option Sales Tax (SPLOST)

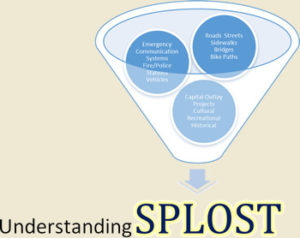

A SPLOST is similar to a LOST in that it imposes a 1% sales tax on the purchase, sale, rental, storage, use or consumption of tangible personal property and related services; beyond that it is very different. The revenues from this tax must be used for capital outlays and the tax is subject to voter approval each time one is levied. This tax is collected by the Department of Revenue and disbursed to the county government and it is distinguished by virtue of being a county tax rather than a joint county-city tax-however, it may be used to fund city projects and often is used for this in counties around Georgia.

As a condition of levying a SPLOST, the county must have a meeting and confer with the city officials at least 30 days before the call for the referendum in order to consider any capital projects for which the cities may seek SPLOST funding. If the county agrees to include a city project(s) in the call for referendum, the county and city must enter into an agreement before the call.

SPLOST cannot typically be levied for more than five years per SPLOST; however, under certain conditions, it can be levied for six years. Prior to a SPLOST referendum, local government officials will identify specific purposes that a SPLOST will be used for. Citizen input is critical to this process and is provided by means of a SPLOST committee made up of local citizens and community leaders not affiliated with the local governments, government-appointed boards or entities that would receive direct benefit from the SPLOST. The SPLOST committee identifies projects needed by the jurisdiction and promotes, educates and informs the community about SPLOST and its potential benefits towards reducing property taxes and maintaining or increasing the quality of government services.

As its name implies, Special Purpose means that a SPLOST can only be used for capital outlay projects specifically identified and named in the referendum and on the ballot when it comes up for citizen approval. These projects by law must fall into the following criteria:

- For improvements to roads, streets and bridges, including sidewalks and bicycle paths;

- Projects for the use and benefit of the entire population of the county such as a county courthouse or administration building; civic center; hospital; jail or detention center; libraries or regional solid waste handling facilities/recycling processing facilities or any combination of such projects;

- A capital outlay project to be operated by a joint authority of the county and one or more municipalities such as a water authority;

- A capital outlay project consisting of a cultural, recreational or historic facility or a facility that combines these purposes;

- The retirement of existing general obligation debt of the county, one or more of the cities or any combination thereof, subject to certain criteria;

- Public safety or airport facilities, or both, or related capital equipment used to operate such facilities such as fire engines, ambulances, airport service equipment and related;

- For obtaining capital equipment used in the conducting of official elections or referenda;

- Capital outlay projects consisting of any transportation facility designed to transport people or goods, including but not limited to railroads, port and harbor facilities, mass transit facilities or a combination of;

- For the use and benefit of the entire county and consisting of a hospital or hospital facility owned by the county or the hospital authority

- Any combination of two or more of the above projects.

Understanding the SPLOST:

- SPLOST funding can only be used for capital outlay projects or the retirement of existing general obligation debt.

- SPLOST projects must be identified and must conform to all conditions of a SPLOST.

- SPLOST is a county initiative, but may include city projects, subject to a written agreement by all parties;

- SPLOST can be levied for five years typically, but can extend to six years under certain circumstances.

- Once all of the conditions are met, the conditions must be spelled out and all capital projects must be on the ballot and presented to the registered voters for approval.

- SPLOST are for a specified period of time and must either be replaced by another SPLOST voted on by the taxpayers prior to the end of its term or it terminates.

- Local governments can sell general obligation bonds to cover immediate capital outlay project costs and use SPLOST proceeds to pay back the bonds or it can utilize the “pay-as-you-go” system or a combination of both. Bonding money allows projects to begin almost immediately after a SPLOST term beings but bears interest charges that are paid back over the course of the bond term; unbounded money is received and deposited until such time as the necessary amounts are available to begin an approved project.

- SPLOST funding pays for capital outlay projects using sales tax monies that otherwise would have to be paid for out of general funds or not funded at all.

SPLOST Funded Projects in Spalding County:

1997 SPLOST Funded Projects

1997 SPLOST Funds Utilized

1997 Report Cards

1997 SPLOST Parks & Recreation

1997 SPLOST Roads & Facilities2005 SPLOST Funded Projects

2005 SPLOST Funds Utilized

2005 SPLOST Revenues

2005 SPLOST Ballot

2008 SPLOST Funded Projects

2008 SPLOST Funds Utilized

2008 SPLOST Revenues

2008 SPLOST Ballot

Click here to view the 2008 and 2015 SPLOST Projects Photo Gallery.

Educational Special Purpose Local Option Sales Tax (E-SPLOST) this is a sales tax that is structured and collected similarly to SPLOST but is imposed by the Local Board of Education with voter approval. The Board of Education has sole discretion for the calling of a referendum for an E-SPLOST vote and can only be used for the following capital outlay projects:

- Capital outlay projects for educational purposes, such as facilities and equipment, and;

- The retirement of existing school system general obligation debt incurred for capital outlay projects, with the requirement that ad valorem property taxes must be reduced by an amount equal to the proceeds applied to debt retirement.

For more information on the E-SPLOST in Spalding County click here.